“In spite of Covid-19, Brexit, and supply chain bottlenecks, we delivered a strong result for 2021. In 2022, we look to raise both revenue and earnings more than 20%,” says Torben Carlsen, CEO.

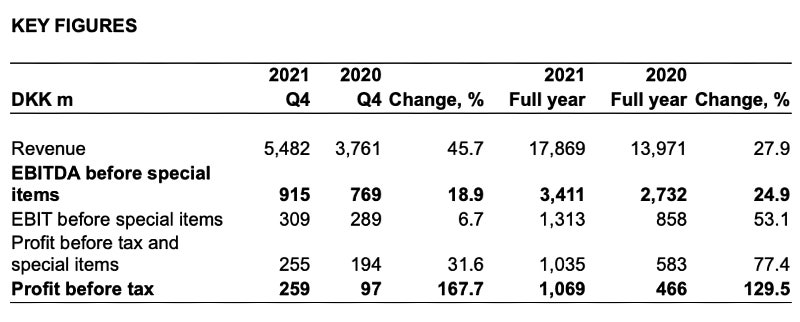

- EBITDA increased 19% to DKK 915m in Q4

- Supply chain bottlenecks eased during Q4

- Early signs of pick-up in passenger numbers

- EBITDA expected to grow more than 20% in 2022

- Total dividend of DKK 8.00 per share planned

OUTLOOK 2022

- EBITDA range DKK 3.9-4.4bn (2021: DKK 3.4bn)

- Revenue growth of 23-27%

- Investments of DKK 2.3bn