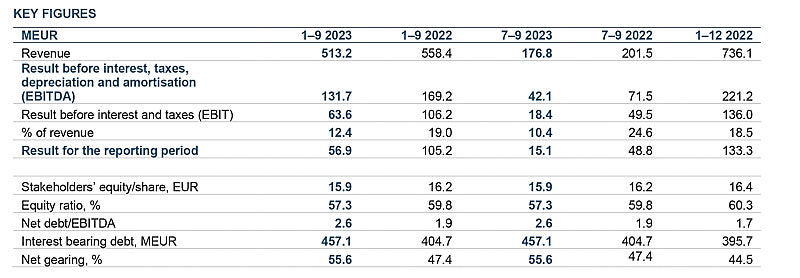

Key figures

January-September 2023

- Revenue EUR 513.2 (558.4 in 2022) million -8%

- EBITDA EUR 131.7 (169.2) million -22%

- Result for the reporting period EUR 56.9 (105.2) million -46%

- Interest bearing debt increased by EUR 52.4 million and was EUR 457.1 (404.7) million at the end of the period.

Q3, 2023

- Revenue EUR 176.8 (201.5 in 2022) million -12%

- EBITDA EUR 42.1 (71.5) million, -41%

- Result for the reporting period EUR 15.1 (48.8) million -69%.

Tom Pippingsköld, President and CEO, in conjunction with the review:

“The geopolitical situation is uncertain, and both global and Euro area demand are slow. The EU is experiencing either negative or stagnant growth. Projections for GDP growth in 2023 and 2024 are modest at 0.6% and 1.1%, respectively. Central banks remain wary of inflation, despite a decrease. The European Central Bank’s swift interest rate hikes have negatively impacted private consumption, construction, and corporate investments, hindering economic activity in EU countries. Finland’s export volumes have decreased by 4.7%, and imports by 9.6% in the last 12 months. There’s a call for the ECB to promptly address the declining growth outlook by reducing interest rates.“

“While the negative development in Finland’s exports and imports have resulted in lower cargo volumes for Finnlines and reduced our result, the upward trend in passenger volumes has been very good. Despite the reduced cargo volumes, Finnlines was able to retain its market share.”

Finnlines took delivery of three hybrid ro-ro vessels already in 2022 and this year, in mid-July, the first of the two Superstar class vessels, Finnsirius, was delivered and entered the Naantali–Långnäs–Kapellskär (Finland–Åland Islands–Sweden) route on 15 September 2023.

The second Superstar ro-pax vessel, Finncanopus will be delivered at the end of the year. Finnlines’ EUR 500-million Green Newbuilding Investment Programme, which started in 2018, is nearly completed.

To read more click cover