Time to say goodbye to the red dolphin: FRS is separating from the subsidiary FRS Iberia.

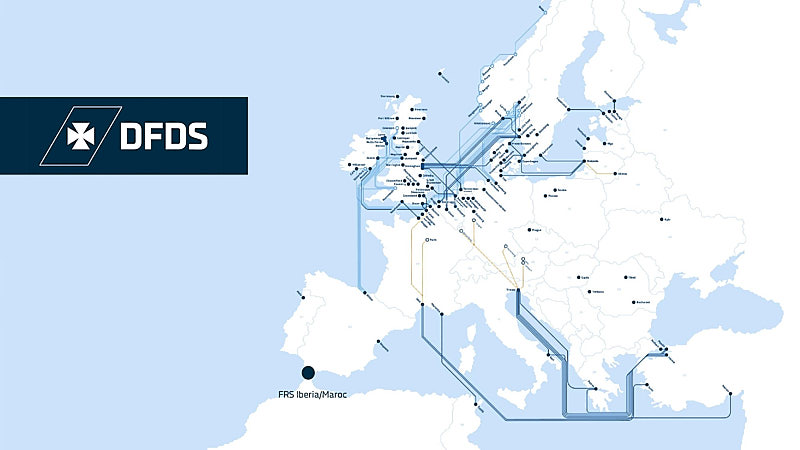

In the future, the ferry lines between Spain and Morocco are going to be operated by DFDS.

FRS Iberia/Maroc operates three short-sea ferry routes across the Strait of Gibraltar:

- Algeciras-Tanger Med

- Algeciras-Ceuta

- Tarifa-Tanger Ville

Prognosis for the year 2023:

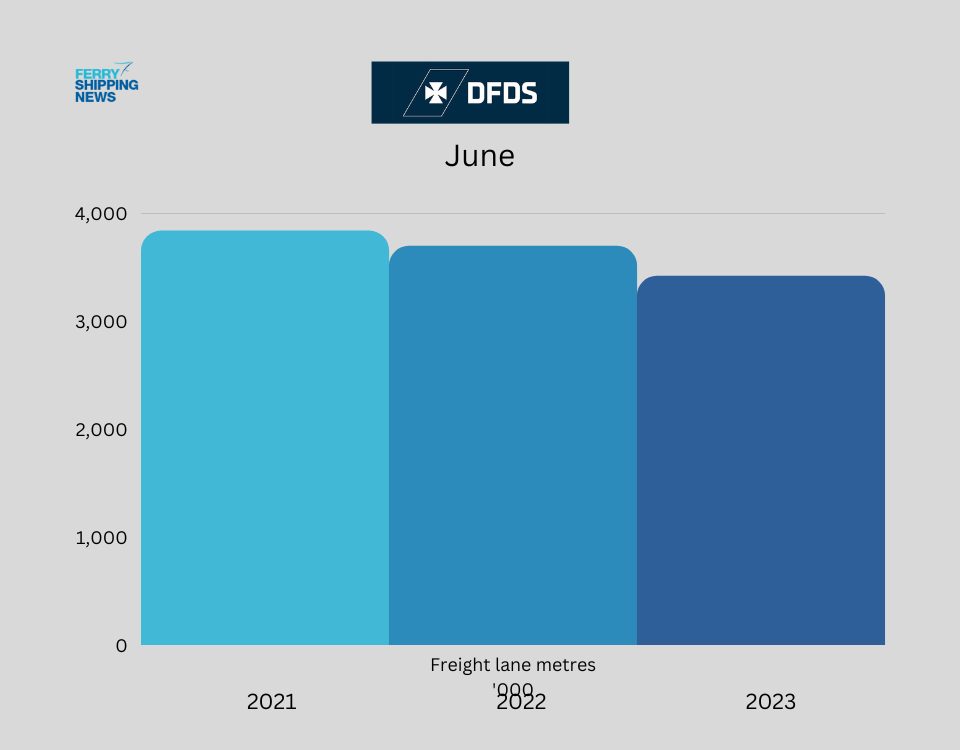

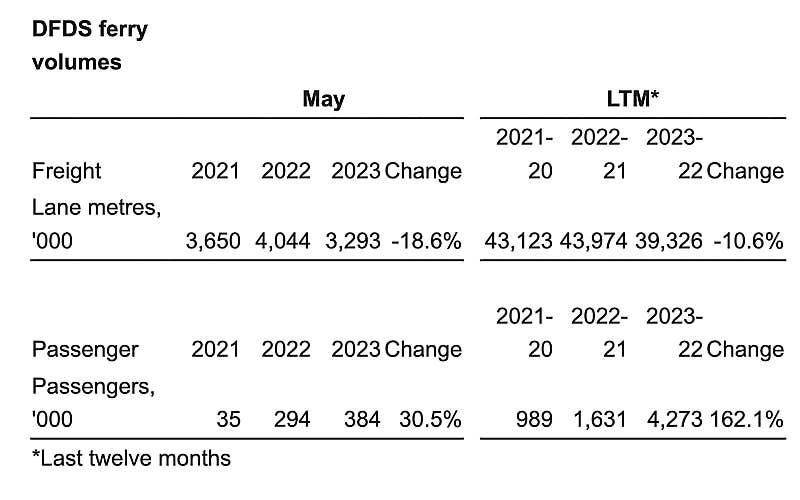

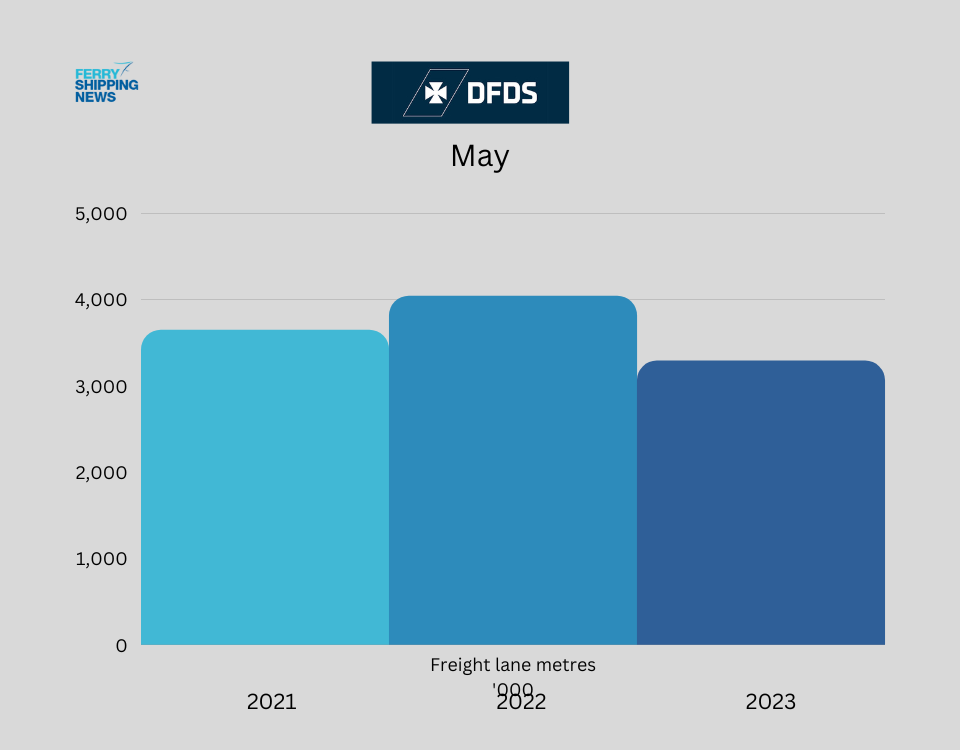

- 3 million freight lane metres

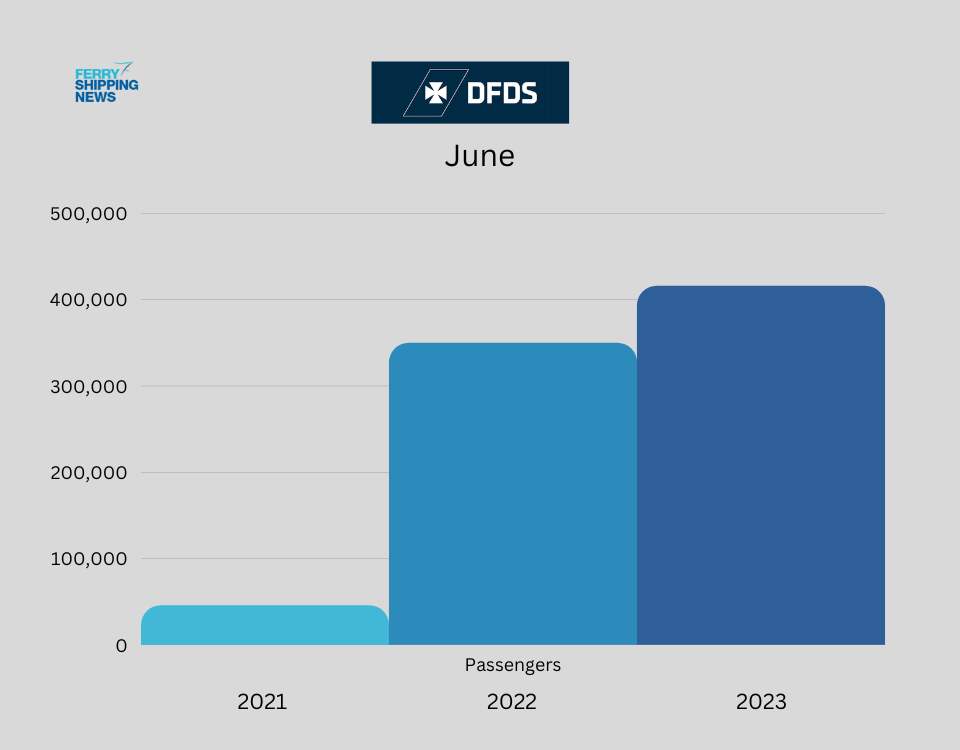

- 9 million passengers

- 370,000 cars

Actual fleet:

- 5 high-speed catamarans

- 2 Ro-Pax

- 1 Ro-Ro

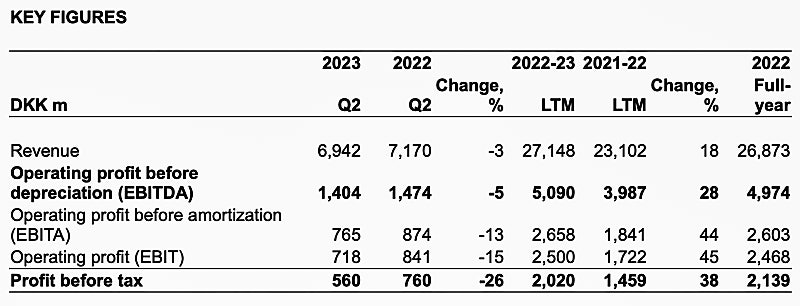

For DFDS, FRS Iberia/Maroc’s key expected financials for 2023 are revenues of DKK 1.0-1.2bn, EBITDA-margin of 18-20%, and EBIT-margin of 11-12%.

The Iberia business has experienced extraordinary success over the course of two decades, despite strong competition. The company is now one of the market leaders in ferry traffic between Spain and Morocco, with strong expertise in the operation of fast ferries and freight traffic. Within the 14 ferry lines of the FRS Group, FRS Iberia is the strongest pillar.

For the CEO of FRS, Götz Becker, the sale of the Iberia business is an important step for the expansion into new markets and a modernized, low-emission development of the ferry group.

What are the advantages for DFDS?

- Ferry network expanded to high-growth Strait of Gibraltar market.

- 8% annual average market growth expected next 5 years.

- Attractive transaction terms.

- Ferry infrastructure & operational development opportunities.

For more insights, consult the PowerPoint presentation presented at the conference call for investors.