DFDS acquires international transport network connecting Türkiye and Europe from Ekol Logistics, strengthening DFDS’ market position in the transport corridor between Türkiye and Europe. The transaction is expected to be completed in Q4 2024, pending EU merger control approval.

Source: DFDS Media

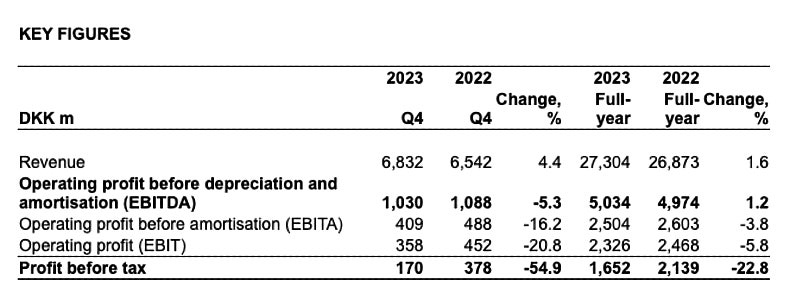

The financial outlook for 2024 has been revised:

- The DFDS Group’s revenue is in 2024 now expected to increase by 8-11% compared to 2023 assuming the acquisition is closed at the beginning of Q4 2024. The previously expected revenue increase in 2024 was 5-8%.

- The 2024 outlook for EBIT is unchanged DKK 2.0-2.4bn.

- Due to an expected integration period of 2-3 years, the time for achieving the financial ambition of a ROIC of around 10% in 2026 is extended to 2027.

- The above-mentioned acquisition is at closing expected to increase DFDS’ financial leverage, NIBD/EBITDA, by around 0.3x on a pro forma basis.

- The financial ambition of reducing financial leverage to 2.5x in 2026 is unchanged as is the financial ambition of generating an annual Adjusted free cash flow of DKK 1.5bn in the period 2024-2026.

Photo: EKOL